Transformation Age: Shaping Your Future, the third publication in the MHI Roadmap Series, is intended to provide material handling, logistics and supply chain industry professionals insights into trends impacting success in the next 10 to 20 years.

Contents

Transformation Age

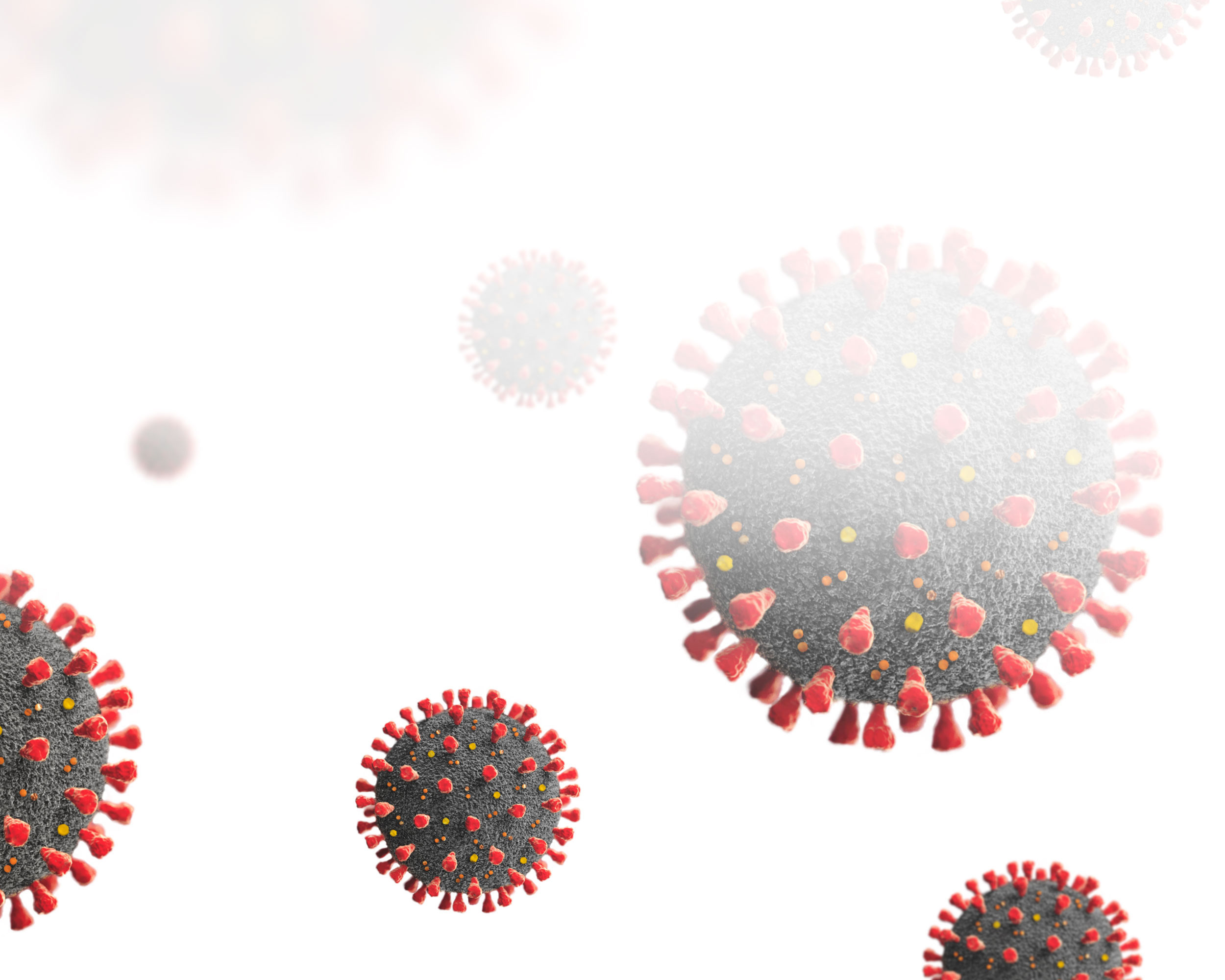

COVID-19

COVID-19 Impact

The effects of the COVID-19 pandemic of 2020 have swept the globe, disrupting daily life in countless ways — big and small. It would be impossible to predict when the virus will run its course, but nearly everyone agrees that the world will ultimately reach a “new normal.”

Some of the predictions found elsewhere in this report have already come to pass: more professionals are working from home (if their job permits), for example. Meanwhile, companies that can afford to do so are accelerating their plans for implementation of digital, next generation technologies and solutions. Taken as a whole, these tools promise the benefits of increased visibility, greater flexibility, and nimble adaptability to the unforeseen.

Moving forward, in addition to technology investments, some organizations will choose to embrace a more regional-local sourcing, manufacturing, and delivery approach — what some call “nearshoring.” Others will be looking to diversify their supplier base. Still others will seek greater balance in inventory management, blending “just-in-time” with “just-in-case.”

Driven by the unprecedented effect of the pandemic, associations and companies across multiple industries sought to collaborate on best practice solutions to safeguard the health and wellbeing of their employees and their customers. This new spirit of cooperation may continue, as organizations reap the benefits of sharing the most effective management tools. Looking ahead, more companies will be evaluating their contingency plans — and their strategic planning process — to shore up shortcomings in their preparations for the unexpected.

Digital Supply Chain Technology Investments To Accelerate

Nobody is as immersed in the supply chain adoption and buying plans trends for NextGen, digital technologies than Thomas Boykin. A leader of Deloitte’s Supply Chain & Network Operations practice, he has served as lead researcher of the MHI Annual Industry Report for the past seven years. He explains why companies will be accelerating their investments in these solutions after another 12 months.

I see COVID-19 as a stress test of the supply chain, and that test revealed some of the vulnerabilities — as well as opportunities — in a revelatory way for many companies, as well as for consumers. That’s because the stakes were much higher than usual. Typically, the stakes for supply chain being effective and efficient are about a company’s survival; in this case, it was about the survival of the people who are the ultimate consumers of the supply chain. In some cases, supply chain inefficiency for personal protection equipment (PPE) put front-line healthcare professionals at risk.

The issues weren’t just about logistics, or moving products, but also about planning. Part of planning is not just predicting and looking forward and forecasting. It’s also about building flexibility and resiliency. COVID-19 exposed that there wasn’t enough attention paid to those potential, critical issues. Going forward, I anticipate organizations will be putting more attention and focus on continually evaluating their supply chains based on key performance indicators to ensure they can quickly adjust to changing conditions and circumstances.

We’ve been actively assessing the rate at which supply chains have been adopting the digital technologies that will help them both predict and respond successfully to challenges for the past seven years in the MHI Annual Industry Report. Things like Big Data, predictive and prescriptive analytics, cloud computing, sensors and automatic identification, artificial intelligence and machine learning, robotics, automation, wearables and mobile technologies, the Internet of Things (IoT), blockchains.

In the most recent report, we shared our findings for projected adoption rates of these digital solutions. Depending on the industry and its current financial situation, I expect those who said they’d be adopting these technologies within 3-5 years will accelerate their pace of adoption to within 1-2 years.

However, I don’t think that timeline will begin for another 12 months at least. Most companies right now are putting off major capital expenditures as they wait to see how the next several months play out. In the meanwhile, I see many organizations shifting into a more strategic planning mode right now, investigating these technologies, their potential use cases, and the benefits they will deliver so they’re ready to implement the solutions when the time comes.

Critically, however, as we discussed in the 2020 MHI Annual Industry Report — and this still holds true, if not more so today in light of the pandemic — solutions that leverage data and technologies that enhance operations work together, in lockstep, to empower the supply chain of the future. No one single technology can deliver the digitization necessary to successfully respond to unforeseen challenges like the one we’re all dealing with right now.

IFS: 70 percent of businesses increase or maintain digital transformation spend amid pandemic

At the end of June 2020, a global research study from IFS Industries — Digital Transformation Investment in 2020 and Beyond: Factors That Will Impact the Success or Failure of Technology Investments in the Post-Pandemic Era — found that 52% of companies plan to increase their spending on digital transformation. Further, the survey indicates that operations concerned with economic disruption were 20% more likely to plan increased spending on digital transformation.

Buying plans differ by industry. The survey found that 75% of respondents in construction will invest this year, followed by information technology (58%) and manufacturing (55%). The most cautious investors are energy and utilities (37%) and retail (35%). The biggest concern among decision makers is the ability to deliver a measurable return on technology investment quickly, and to the satisfaction of internal stakeholders (64%).

“The study confirms that many companies are wisely using the global downturn to divert resources to technological renewal and innovation,” says Antony Bourne, IFS Industries Senior Vice President. “As the majority of businesses are adapting to the anticipated economic recovery, and not permanently scrapping digital transformation initiatives, there is reason to believe that companies with a progressive mindset toward technology investment will be well equipped to rebound.”

Digitization, Automation Investments Should Accelerate Due to COVID-19

David Maloney, Editorial Director of DC Velocity, shares insights into the types of digital and automated technologies companies are considering during the pandemic.

Will COVID-19 accelerate digitization of the supply chain?

I think the companies that already had digitization on their strategic roadmaps are probably going to proceed with that investment. You’re also going to have companies who are who were thinking about digitizing, and now realize they need to accelerate that strategy to have better information to know how to respond quickly, because the pandemic and its impact are moving targets. Digitization helps operations manage better in an environment where things are changing rapidly, and you need flexibility to respond quickly.

As part of digitization, I think there will be growth in Internet of Things (IoT) technologies, where products or parts of the operation relay data on status back to a central gatekeeper. That allows an operation to utilize that information to make better, more timely business decisions based on the feedback from the sensors on the products or within the operations.

But I also think there will be a lot of companies that sit on the fence because they’re afraid to make the wrong move. Obviously, what happens with the economy will impact buying plans. We saw everything fall off a cliff, so to speak. Currently, it’s unclear if the recovery will be U-, V-, or swoosh-shaped. And different sectors will likely recover in different rates. As of this moment, I feel a lot of investment will be predicated on whether or not there’s a second wave of COVID-19. Nothing’s going to be resolved until we get a vaccine that works and that people are willing to take.

What about investments in automation technologies as a result of the pandemic?

It should accelerate, but I don’t know if it will. Companies may not want to spend the money because it can be a very expensive transformation. Most of the suppliers I’ve talked to report they’re getting a lot of inquiries, and a lot of companies are saying they wished they had made those investments two years ago.

I think overall, consumers are still not spending as much as they did before due to the uncertainty about the economy. I’m not sure how quickly traditional retail will come back. Many people are still nervous about re-entering physical stores because of other customers not following social distancing rules. Retailers can, of course, do pick-and-collect for their customers. But hand-picking items, such as groceries, from store shelves is extremely labor-intensive and most retailers can’t make money doing that. That makes automated goods-to-person micro-fulfillment a very good answer because it allows retailers to utilize floorspace they already have in their stores to accommodate customer pick-ups. However, they have to choose systems that can be implemented quickly and cost-effectively.

In the warehouse, I think investment in picking robotics is going to be a lot bigger as their ability to employ artificial intelligence (AI) and deep learning advances. I interviewed a company, Covariant, for our August issue, and they talked about using AI to enable trial-and-error learning. After one robot figures out how to correctly perform a process, it shares that learning with all the other robots in the system.

Cobots are also going to be big too, as they allow people to work collaboratively with robots for less human interaction. For example, I think we’ll see more picking stations where humans pick the more complicated items, and robots pick the lighter items that are easier to maneuver.

Coresight Research: As Lockdowns End, Online Grocery Shopping Slows

As local U.S. governments begin easing restrictions and shelter-in-place mandates, consumers are buying groceries online with less frequency, according to the June 17, 2020 weekly consumer survey by Coresight Research. The findings note a week-over-week decline in the proportion of respondents who have bought groceries online in the past two weeks, from 31% to 29%. Further, expectations of buying groceries online are down by around four percentage points versus actual behavior in the past two weeks (as shown in Figure 1).

Supply Chains’ Post-Pandemic Automation Investment Plans Mixed

With a four-decade career covering supply chain and material handling, Bob Trebilcock, Editorial Director of Supply Chain Management Review and Executive Editor of Modern Materials Handling has been reporting industry developments from the onset of the pandemic. Here’s what he’s hearing from multiple sources about the post-COVID-19 supply chain of the future.

What are some of the lessons supply chains will take from the pandemic?

I recently moderated a webinar featuring two academics who study procurement and operations. They started by noting that COVID-19 was a 100-year event; heck, it might even be a 500-year event. You might think, ‘how often does a 100-year event actually happen?’ But they shared some pretty high percentages about such occurrences, which may or may not be a pandemic. The lesson to be learned is two-fold: one, your company needs to have a playbook about how to respond to a crisis; and two, you need to address whatever operational deficiencies that were exposed by the pandemic. If there was something that was hindering your performance, then you need to fix it.

What kinds of technologies will be applied because of the pandemic?

Frankly, I believe we’re still in firefighting mode. People are still trying to figure out what problems they need to solve. But I believe that the pandemic will be with us until we have a vaccine, and that may be as far away as 12 to 24 months. So, then we’re all going to have to learn how to live with it. We can’t keep shutting everything down forever. Companies are going to have to think differently inside the four walls of their warehouse.

That said, safety is still number one and now it’s taking on a different dimension beyond physical injury and into protecting health. Therefore, I think companies are going to look for tools that help minimize contact. I recently talked to a warehouse management software (WMS) company that can route picking traffic in a certain way to minimize human contact in the aisles, as well as at the time clock and the lunchroom.

It follows that warehouses, which are already looking to reduce the number of touches per product for cost cutting, might now be worried that every time something is touched there’s the potential for cross-contamination. I think that could hasten the adoption of automation, as well as of autonomous mobile robots (AMRs). The robotics companies I’ve spoken with say they’re getting all kinds of inquiries. Notably, however, none have said they’re getting all kinds of orders. Likewise, I recently spoke to a supplier of goods-to-person automated picking solutions. They are seeing some companies accelerate their buying plans, others putting their current orders on hold, and a third group making inquiries.

We’ve also been doing a lot of surveys, including one on NextGen technologies, and questions include buying plans over the next 12-24 months. When we asked if companies were planning to increase, decrease, or pause their investments in automation because of COVID-19, it was roughly an even split among the three. When we asked if companies were considering investing in robotics due to the pandemic, it was around 28% that said yes. That may not seem huge, but year-over-year for our survey, that’s the highest percentage we’ve ever seen.

Are current social distancing efforts impacting productivity within facilities?

To share a specific example, I’m doing a podcast called The Rebound with Abe Eshkenazi, CEO of the Association for Supply Chain Management (ASCM). We just did an episode featuring Greg Toornman, VP of Global Materials for AGCO. AGCO is one of the world’s largest manufacturers of agricultural equipment and spare parts, operating in 30-plus companies. When rumblings started coming out of China in January about the Coronavirus, they listened. Particularly as three of their biggest supply bases are in China, Italy, and Brazil — three of the areas hit hardest by the pandemic worldwide.

AGCO immediately implemented policies and practices for safe operation at their Wuhan plant in China once they were allowed to reopen. Initially the facility shipped 10 containers a week instead of their usual 75; within two weeks — once the new safety procedures became second nature — they were back at their normal output. And within a week after that they shipped 105 containers. Then, they applied their experience in Wuhan to Italy. They also stockpiled personal protective equipment (PPE) in a central facility in the U.S. In addition to distributing it to their plants, they also shared it with their suppliers, who were asked to prioritize AGCO’s orders.

What will the impact of COVID-19 be on Lean supply chains?

What’s the alternative to Lean and just-in-time? Fat, or just-in-case. When I interviewed the President of UPS’ supply chain solutions division for July’s Modern Materials Handling cover story, we discussed this. He relayed that in the conversations he’s had with companies, there’s a lot of talk about just-in-case inventory, but it’s mostly just talk. I think we’ll see some of that occur, but I don’t think it’s the end of Lean.

I think we will see more nearshoring, also called reshoring. Part of the argument for that approach is it shortens your supply chain by getting your inventory closer to the point of consumption. I suspect the pandemic will accelerate a movement toward more regional-local production. Meaning products are built within a given market to be sold within that region, as opposed to having one plant in one place that ships products all over the world. That trend is not new, but I think it will accelerate for certain products such as pharmaceuticals.

Did COVID-19 Kill “Lean”?

That’s the question posed in an article in The Load Star by Cathy Morrow Roberson entitled, “Coronavirus May Mean the End of Just-In-Time, As We Know It.” In the piece, she explains that the practice no longer works, pointing to the automotive inventory by way of example.

“Thanks to natural disasters, such as the Japanese tsunami and earthquake in 2011, fluctuating transport and fuel costs, recent tariffs and other disruptive incidents over the years, costs have often outweighed the benefits of just-in-time, depending on individual companies that practice this process.”

Roberson argues for the practice to be used more wisely going forward, possibly through near shoring. It’s part of the argument for re-balancing priorities from just-in-time to just-in-case supply chains, whose characteristics are explored in this article from Lauren Pittelli in IndustryWeek. She writes: “To withstand a crisis, or better yet to come out of it stronger, balance the low cost and efficiency of the JIT model with the need to be nimble and agile in reacting to market changes.”

Robert Martichenko, ALAN Board Member and Founder/CEO of LeanCor Supply Chain Group recently wrote a white paper, “Post COVID-19 Crisis Supply Chain: A Time to Rise,” agrees. He believes supply chain professionals are uniquely equipped to develop inventory optimization solutions to the shortfalls experienced in personal protective equipment (PPE), ventilators, medications, masks, hand sanitizers and disinfectants experienced during the immediate weeks after the pandemic reached U.S. shores.

AI Investments Will Be Fast-Tracked Across Supply Chains

Jim Tompkins, Chairman of Tompkins International, is widely recognized as a supply chain consulting and solutions guru. He believes strongly that — as a result of COVID-19 — investments in artificial intelligence (AI) will be greatly accelerated across nearly every aspect of supply chains. He explains why, here.

COVID-19 has accelerated history. Chances are good that the bulk of the predictions in MHI’s Transformation Age report are going to happen. But they’re going to happen a lot faster than initially anticipated, because nobody could foresee that this pandemic. Therefore, the supply chain now has to do the same — accelerate the solutions. I see this as an opportunity for organizations to leverage artificial intelligence (AI).

Forecasting is the first area where we’ll see an acceleration of AI applied. Because historically, when we’ve had disruptions, they were disruptions of supply. In the pandemic, however, there’s been disruption of supply AND demand — and demand is typically constant.

Take the toilet paper shortage. Why did that happen? Not because there wasn’t enough toilet paper. It’s because manufacturers were making the wrong type of toilet paper. Two-ply is what consumers use at home; single-ply is what businesses use in offices, restaurants, retail stores and so on. Production of both remained constant, but more people were home and fewer people were at work or out in public. The single-ply wasn’t selling.

The toilet paper challenge was rooted in a lack of ability to manage the supply to the demand, because manufacturers didn’t know what the demand is going to be. Therefore, supply chains need forecasting augmented with AI in order to not only predict the demand, but also to predict the amount of supply they will need. Ultimately this will help synchronize supply and demand.

Next, companies need to accelerate the application of AI to gain better visibility. It’s no longer enough to know that the boat of product left China two days late; now operations managers need to know the impact of that delay when the boat arrives in Los Angeles. With AI, a company can be aware two weeks in advance that its factory in Columbus, Ohio, won’t have its supply as expected. The enhanced intelligence utilizes an AI mechanism to inform the visibility.

I also see accelerated AI application to multi-channel networks. If all you’re doing is selling in your own stores and on your own website, it’s pretty easy. But with the growth of e-commerce, different people are shopping in different places based on demographics, and they’re shopping on websites built for them. Therefore, those retailers need to be able to manage those multi-channels in an integrated solution, and to do that successfully they need to use AI.

All of these capabilities are no longer nice to have; now they’re mandatory. That’s why the adoption of AI is going to be a lot faster than originally anticipated. Personally, I’ve learned more in the last three months that I’ve learned the last three years. The pace at which all this is happening is unbelievable. Now is not the time to sit back and watch the world go by. It’s time to get on top of the horse and then ride off and make something happen, because action is required.

AI in Supply Chain Projected To Grow at 45.3% CAGR from 2019

According to research from Meticulous Market Research, the artificial intelligence (AI) in supply chain market is expected to grow at a compound annual growth rate (CAGR) of 45.3% from 2019 to 2027 to reach $21.8 billion by 2027. The researchers attribute this growth to:

- Rising awareness of AI, big data and analytics

- Broader implementation of computer vision in both autonomous and semi-autonomous applications

- Continuous technological advancements in the supply chain industry

- Increased demand for AI-based business automation solutions

- Expanding industrial automation

The researchers note potential impediments to AI’s growth in supply chain currently include high deployment and operating costs, as well as a lack of infrastructure.

Thoughts on Organizations’ Post-Pandemic Digital Investment Plans, Timelines

As a supply chain and IT strategist and researcher, Dr. Randy V. Bradley, Associate Professor of Information Systems and Supply Chain Management in the Haslam College of Business at The University of Tennessee, Knoxville, is an expert in digital business transformation, supply chain digitalization, and the strategic application of business analytics and IT in the supply chain. Here, he offers his thoughts on the organizations’ post-pandemic digital investment strategies.

As a result of the pandemic, do you expect more companies to embrace supply chain digitization?

The pandemic and the issues that organizations have faced as a result of it have likely increased the desire to think about pursuing digitalization — not just automation. I want to clarify this distinction, because a lot of technologies that are referred to as automation are actually mechanization: that is, equipment that replaces a human to perform a repetitive task. However, that mechanized equipment doesn’t necessarily generate actionable information that supply chains and supply chain professionals could use.

If an organization does this correctly — innovates, uses and leverages emerging digital technologies —those solutions should not steal jobs, but rather they should fill gaps in talent, knowledge, capabilities and bodies. When you think about COVID-19, particularly in the material handling space, if you need to social distance in a warehouse, you can’t easily retrofit or redesign the facility to enable more square footage for your people to maneuver. Instead, you’re going to have to reconsider the way you deploy those individuals, which may mean fewer people per shift. And that could have a huge impact on productivity.

That begs the question, can we now leverage autonomous solutions, such as autonomous mobile robots (AMRs), to support the need for productivity without having as many people within a certain square footage of each other? AMRs enable an operation to have fewer people on a given shift. They can run more shifts to spread out their people but can still have that same level of — if not better — productivity. Alternately, they could utilize collaborative robots, increasing human-to-robot interaction while minimizing the need for human-to-human interaction.

With COVID-19, will investment in automation, such as AMRs or cobots for example, accelerate?

Currently, when surveying on investment plans in the MHI Annual Industry Report, we’ve we talked about advanced robotics and automation holistically. [In the 2020 report, 73% of respondents anticipated investing in robotics and automation within the next five years.] Going forward, we probably need to get more granular and separate that category into different technologies and specific use cases to better determine what are the optimal tasks for robotic solutions.

To answer your question, yes, I think so. With the 2019 MHI Annual Industry Report we saw an inflection point [with projected spending on robotic and automated solutions up 95% in 2019 after a trend in respondents reporting a decline from 2015 to 2018]. To us, that seemed to indicate the end of the pilot projects and the beginning of the actual investments as companies began to realize the potential use cases and subsequent benefits. Simultaneously, we began to see new funding models, such as robots-as-a-service, which enabled organizations to acquire robots as an operating expense instead of as a capital expenditure.

What sectors are most likely to make these investments post-COVID-19, and when?

The ones that are not financially strapped. Hospitals, for example, took a big revenue hit during the shutdown as they stopped doing elective procedures, which are a prime revenue generator. Sectors like that won’t have the cash flow to enable them to move forward. In the fulfillment space, yes — they’re bursting at the seams with increased demand and struggling to keep up with it — I see more investments coming from there.

When we look at material handling, it’s going to depend on what segment of the economy they cater to, because there’s going to be heightened desire for those automated solutions; as a result, we will see increased adoptions. However, I think the increase in adoptions is going to pale in comparison to what it would have been had most organizations’ financial position been at the same level coming out of this pandemic as it was going into it back in early March.

As for the timeframe, in my opinion, we won’t see an exponential increase in the adoption of these types of technologies for about 36 months from now. The best case for some organizations is maybe 24 months. The reason is practicality — the human factor. If we’re at least 12 months away from the release of the first viable vaccine, how many people are willing to sign up for that? Nobody I know, because people understand that there is a tremendous risk when you rush a vaccine to market.

That’s why I think adoption of digital and automated technologies will be slow for two to three years, then it’s going to be exponential. Not because I don’t believe in the benefits the solutions can deliver, but because of human nature. When I work with executives in our leadership programs, I almost always first ask them to identify their personal affinity to adopt new technologies as a consumer. Then I ask them a series of questions about how they make decisions for their organization specific to the innovation adoption cycle and process. It’s almost always a near perfect correlation. Many people, and organizations, are going to ease into investing in digital technologies solutions primarily because of a need to better manage cashflow. They’ll also act out of caution or concern about the uncertainty of a second — or third — wave of lockdowns due to a resurgence of COVID-19 cases.

In what other areas do you think organizations will ultimately invest?

I think we’re going to see investments in visibility solutions. Currently, many organizations have limited upstream visibility; they can’t see beyond Tier One or, at best, Tier Two. The pandemic brought to light that this is a major problem that can no longer be ignored or put on the shelf to be dealt with at a later time. Companies will have to revisit their sourcing strategies to assess the point of origin of materials, because even if you have six potential sources of supply, if there’s a single point of origin, you’re still going experience disruption. I also think we’re going to see an increase in risk analysis solutions, as well as expanded capabilities within those solutions so organizations can manipulate a risk model to assess potential impacts, such as digital twin simulations.

Futurist Expects Significant Changes to Food, Medical Supply Chains

Jason Schenker, Chairman of The Futurist Institute and President of Prestige Economics published his newest book, “The Future After COVID: Futurist Expectations for Changes, Challenges, and Opportunities after the COVID-19 Pandemic,” on April 1, 2020. The following is an excerpt of that publication.

Paper product and fresh food shortages in the United States resulting from the COVID-19 pandemic came as a surprise to many people. But as a result of this dynamic, many people have also come to recognize the importance of the U.S. supply chain, the global supply chain, supply chain and material handling industries, and the challenges of the last mile.

The COVID-19 pandemic experience was jostling for many Americans, and there are significant changes to supply chain that I expect we will likely see in the post-pandemic period.

First, the vulnerability of U.S. and global supply chains have been revealed. I believe that it should now be clear to many that disruptions in the supply chain can occur anywhere in the global economy and that the negative impacts of supply chain disruptions can be exacerbated when inventories are thin.

Second, medical supplies and medical devices that had long been taken for granted as easily accessible have been revealed to be sometimes difficult to obtain. Hearing from medical professionals looking to reuse previously single-use personal protection equipment (PPE) or medical devices is scary. In the future, the medical supply chain is likely to be recognized as more critical. And policies are likely to be enacted to reduce medical supply chain risks.

Third, the supply chain of the U.S. economy is something that almost everyone now more clearly understands. The words “supply chain” were barely uttered in business schools in the 1990s and early 2000s. But now, supply chain needs to be a top-of-mind topic for every executive, every politician, every leader, and every consumer.

Changes in Medical and PPE Supply Chains

It is very difficult to have both a thin supply chain and very large distances across your supply chain. In fact, very thin inventories plus a very long supply chain can be a recipe for disaster during times of disaster, which is exactly what we have seen as a result of the COVID-19 pandemic.

As a result of this experience, we are likely to see a future shift of policies and strategies to favor more robust inventories spread across supply chains. This could include some regulatory incentives and/or mandates related to the manufacture, storage, and inventory of medical and PPE supplies in the future.

It is also quite conceivable that there could be a regulatory or policy attempt to completely reshape the entire supply chains for medical equipment and PPE, so that more goods are produced within the United States or the USMCA/NAFTA region. Shortening the distances of supply chains can help counteract the risk that accompanies supply chain inventories that have been spread thin. And global supply chain risks are inherently greater than domestic supply chain risks because of the distance, number of parties, and regulations involved.

Awareness of Supply Chains

One big impact of the recent COVID-19 pandemic is that people are likely to be more aware of supply chains. And they may be less likely to run down their own “at-home” inventories of food, paper products, cleaning products, and other goods. In other words, people might keep more things at their house.

Because people have been able to get goods with relative ease for some time, people did not worry about what was in their cupboard. After all, you don’t mind if you have a bare cupboard if you can get whatever food you need to your house in under 20 minutes.

But in the COVID-19 pandemic situation, people found supply chains disrupted while their cupboards were also bare. This problem became exacerbated by the risk that people might need to stay in their homes for extended periods. People had to restock their cupboards rapidly because they had low in-home inventories and they expected a rise in demand as alternative sources of food (e.g., restaurants) became less viable.

In the future, we will want more secure supply chains. But it remains to be seen if people will prevent their cupboards from going bare again after the COVID-19 pandemic passes.

Ultimately,I believe we could see additional financial incentives or regulatory incentives from the government that shore up the supply chain in the future.

The Future Nexus of Supply Chains and National Security

For U.S. national security, the COVID-19 pandemic exposed the importance of being vigilant with our borders. It also highlighted the risks of overly thin supply chains, as well as the potential downside of being dependent on the global supply chain for critical goods — like medical supplies, medical devices, basic necessities, and personal protective equipment (PPE), including gloves and masks. How might this impact our national security.

Jason Schenker recently contributed an article to the Air Force Warfighting Integration Capability (AFWIC) publication, “Global Futures Report: Alternative Futures of Geopolitical Competition in a Post-COVID-19 World.” He writes:

The United States from a national security perspective may very well wish to more firmly shore up technology, healthcare, medical, food, consumables, and other supply chains in order to ensure maximum stability over time. Additionally, COVID-19 has inadvertently revealed that a pandemic-level bio attack on the United States could be beyond economically devastating.

If adversaries of the United States were to implement such an attack, they could pair such action with social media and traditional media disinformation for maximum disruption, political destabilization, and economic devastation in a way that could completely destabilize the United States as an entity for at least a brief period of time.

COVID-19’s Impact on Cities, Deliveries

Dr. Anne Goodchild is Founding Director of the University of Washington’s Supply Chain Transportation and Logistics Center and its Urban Freight Lab. An expert on last-mile and last-50-feet deliveries — specifically in metropolitan areas — she discusses how cities and their citizens might change as a result of the pandemic.

If more people who can do so continue to work from home, how will cities be affected?

I think the movement to working from home will be accelerated as part of social distancing measures. Particularly for the people whose companies were essentially required to implement that practice as part of protecting their employees. Post-pandemic, there won’t be an insignificant percentage of people who continue to work at home. But, at the same time, there will still be a huge percentage of the workforce that has to be at their place of business.

As a result of that, in the short term there was initially a dramatic cut in the amount of urban traffic. Here in the Seattle area, we saw reductions of roughly 85% in peak period travel at the high point of our “Stay Home, Stay Healthy” mandate. Now, in the Seattle area, traffic is only down about 35% and as of today, mid-June, we’re still in Phase 1+ of the four stages of recovery. Traffic has picked up to the point that there is congestion now during peak periods; this is the experience in most metropolitan areas. Further, there’s some concern that cities will actually have more congestion than before the pandemic because now people aren’t comfortable ride sharing. They’d prefer to be alone in their cars than using public transit.

Will people likewise be less comfortable living in more densely populated areas?

Humans have been urbanizing for hundreds of years and pandemics have occurred before. There is some discussion that cities maybe won’t have the same appeal post-COVID-19, but the arc of history has always been towards urbanization. In the grand scheme of things, I am sure that we will see a short term effect, but I’m quite confident that in the long term, the same economic principles of why cities are the most productive, the most economically robust, and the most innovative places in the world, people will continue to be there.

How might last-50-feet deliveries change going forward?

First, many more people are using delivery services now, and we expect that to continue — perhaps not at the same rate — along with accelerated adoption of online purchasing. Although the types of deliveries are quite nuanced. There’s prepared food picked up at a restaurant and delivered by services like Uber Eats, there’s grocery deliveries coming from a warehouse, and there’s traditional truck deliveries from UPS and FedEx. So, while there’s definitely been increased growth in deliveries, there’s quite a bit of variation in traffic patterns around the types of vehicles and the times of day.

There’s also been an increase in home deliveries compared to business deliveries because people are home more. That’s something we’ve been studying because we look in a quite detailed way at infrastructure and parking and curb space. That change can have a significant impact on how to manage the city and what kind of traffic can be expected in different parts of the city at different times.

As a result of the increase in deliveries, I believe we’ll be seeing larger and faster adoption of technologies that support secure, touchless parcel exchanges. We’ve been testing locker systems for a couple of years now to assess their impact on congestion, delivery time, and other operational benefits, such as how they separate the delivery driver and the package receiver. Because of that, we see a lot more interest from shared apartment buildings as the lockers reduce the risk of introducing a potential vector for the virus. That was something landlords were interested in before COVID-19; now it’s changed their level of motivation to put lockers into practice.

Post-COVID-19 Supply Chains Will Benefit from Cross-Industry Collaboration, Better Contingency Planning

A conversation with Kathy Fulton, Executive Director of the American Logistics Aid Network (ALAN), which leverages supply chain expertise to solve disaster recovery challenges while most efficiently and effectively getting critical aid to survivors. As a disaster-preparedness expert, Fulton offers her thoughts in this discussion of the impact of the pandemic on supply chains of the future.

Will there be an acceleration in investment and application of digital technology in supply chains because of COVID-19?

According to the people I’ve been talking to, yes. ALAN has regular contact with our business partners who report having accelerated five-year digital implementation plan to execution in the past two-and-a-half months. But to do that requires infrastructure, investment, installers — all things also disrupted by the virus. That’s compounded by market volatility, as well as limited access to the integrators and installers whose companies are not allowing them to travel, and warehouses that are limiting access by outsiders. Therefore, at this moment, I see a desire to accelerate digital investments, but a struggle to balance that with availability of assets.

Further, whatever digital solution a company chooses to invest in has to make financial sense for the business going forward. For example, they’re thinking about: Will people continue to embrace pickup or home delivery of groceries? Will consumers still be willing to pay for those services once the pandemic slows down or ends? How can stores provide those services efficiently and cost effectively? Accelerated investment in digital supply chain technologies has to make financial sense for the business and ease of use for the consumer.

How will companies keep their employees both safe and productive moving forward?

Twenty years ago, when remote work tools began to appear, companies started including a work-from-home strategy in their business continuity plans. Now, with COVID-19, multiple companies have had to execute that plan for employees whose jobs can be done at home. I have heard, however, that some companies have struggled to put this into action for reasons such as they didn’t have enough remote work licenses for their software.

At the same time, we’re talking logistics and supply chain. There are some roles that can’t be done from home. We’re seeing many operations implementing health and safety policies to keep their employees safe. In warehouses, cleaning and social distancing policies seem to be working. Those added measures don’t appear to be significantly impacting productivity or throughput.

What has been a challenge are the value-added assembly and light manufacturing or processing lines where people stand shoulder-to-shoulder, side-by-side. Those operations are where we’re seeing the outbreaks, so we’re seeing more plastic or plexiglass shields. But those operations are still trying to figure out how to adjust their workflow to account for increased protection measures.

My takeaway is: What a time to be an industrial engineer and working in supply chain! Up until mid-February in the U.S., your job was to figure out how to use the least amount of space to get the most product pushed through. Now, your optimization equation has changed to, how do we keep our employees healthy and safe while still maximizing throughput? Perhaps by increasing space or staggering shifts. Going forward, these sorts of measures will not be just nice to have, but rather an operational requirement.

Do you think there will be mandates from OSHA or the CDC about such requirements or regulations?

Currently, the government institutions have only issued guidelines, but no mandatory requirements; what they will do next is outside my knowledge zone. Right now, however, it’s been incredible to see businesses rapidly create — and more importantly, share — policies and best practices on how to keep their employees safe. I am grateful that multiple association leaders are willingly sharing members’ policies on their websites or by email for companies across diverse industries to utilize and adapt to their unique operations. When this situation resolves, I hope this sense of collaboration continues.

As an organization that leaps into action in areas that have experienced a disaster, what are your thoughts on the future of urbanization? Will people be less likely to want to live in cities?

The World Economic Forum recently published an article on this topic that predicts that COVID-19 will reverse the increased globalization and urbanization we’ve seen over the past several decades. It also talks about bringing more manufacturing back to North America. I don’t necessarily think that is going to be the way of the future, but I do think that as a country we will probably be less urban. Before the pandemic, we were already seeing companies establish smaller distribution centers (DCs) closer to population centers as a means to provide faster delivery. Moving DCs closer to smaller population centers tends to attract people to that area because there are jobs, and it’s easier to social distance in less urban areas.

Any other predictions for COVID-19’s impact on supply chains of the future?

When I think about disruptions like the pandemic, my hope is that companies have learned a little bit of a lesson about the importance of preparing their businesses and their employees to work through disruption. Notably, our supply chains never failed. They were stretched really thin, but we never lost critical capacity across any of our supply chains or transportation. Toilet paper was still being manufactured. Meat was still being processed. Throughout the shutdown, the people doing the work within logistics and running supply chains figured out a way to get things to people who needed them.

Transformation Age

Shaping Your Future

It came sooner than many thought.

The Transformation Age is in full swing and with it comes a heightened environment of change, uncertainty and complexity.

In 2020, the material handling and logistics industry is experiencing rapid change, diverse opinions on the sure path to success, and shifting demographic profiles and skills sets of industry leaders. All sectors are beset with unending announcements of new technologies and equipment upgrades, as well as growing customer demands for immediacy and customization.

Industry leaders are accustomed to change and good at adapting to new market requirements. But the magnitude of the shifts underway are exceeding even the expectations of the largest companies and the most experienced integrators.

The Transformation Age brings great change, but also tremendous opportunity.

Key questions include how will this environment shape the industry going forward and what strategies will enable companies to survive and succeed.

What factors will distinguish market leaders from average players and leave some players lagging behind?

Which trends will emerge as long-term factors and which ones will fade from the headlines?

A single transformative technology shift can spark innovations, discovery and new capabilities. Those developments, in turn, lead to multiple advancements in design, manufacturing and delivery that move the needle significantly for the evolution, and, indeed, transformation of industries.

And the time is ripe for such opportunity in the Transformation Age.

When taken individually, key industry trends are forces around which business strategies should be built and executed. When they occur as an integrated set of factors, each morphing with a different velocity and timing, the call to action is something larger, requiring new business models and shifts in skills sets and expertise.

Leadership

Leadership is key. Transformation of companies must be owned at the top.

One thing is clear. Leaders must fully own shaping their company’s future. This is not a task for delegation. It is one to be owned at the top and developed with thoughtful, deliberate collaboration.

Go first with new behaviors and practices to signal meaningful shifts in expectations and culture.

Shaping a company’s future requires vision, planning, an appetite for change, and above all, communication with the board of directors, the executive team, the broader workforce, suppliers, customers and other key stakeholders.

Vision and change management are two critical leadership requirements in this environment. Courage, collaboration, flexibility and resilience are vital attributes.

Thought leadership must evolve to a new, flexible and dynamic process.

Success in this environment requires an evolutionary shift in thinking…

Success in this environment requires an evolutionary shift in thinking, one that moves from a focus on doing more of the same, or even using better approaches for traditional processes, to one that encompasses options for accomplishing goals in new and different ways. This transformation in thought leads to evolution of approaches and development of new ideas and solutions.

Leaders must prepare and engage their organizations for these shifts. Fear is the most pervasive emotion expressed by employees facing significant change in the workplace. Lack of understanding, buy-in and execution of new goals, approaches and processes will derail even the most effective plans.

Engagement and collaborative planning are essential. One-off initiatives don’t work for broad and deep lasting change. Engagement of the board of directors and alignment across the senior leadership team are critical first steps in implementing transformative change. Education on trends, opportunities and barriers coupled with scenario planning to address multiple strategic and tactical options engages both groups in the initial exploration of ideas. Without the understanding and a consensus buy-in by these two groups, the organization will falter in implementing strategic initiatives.

Download Section PDF “Shaping Your Future”

George Prest, CEO, MHI

Leadership vision and planning are critical elements in shaping a company’s future. Market information and insights play a key role in strategy development. The Transformation Age: Shaping Your Future report paints a picture of market and industry trends that will present opportunities and challenges to companies in the material handling, logistics and supply chain industry over the next two decades.

Read MoreEmmy Lou J. Burchette, President & CEO, Burchette & Associates

The Transformation Age: Shaping Your Future report represents an evolution in the approach to the MHI Roadmap Series. For this edition, we combined insights from in-depth personal interviews with industry leaders and trend experts with findings from secondary market research to provide perspectives on ways material handling and logistics companies should prepare and take action to be successful in the coming decade.

Read MoreOperating Models

To win in this era, a new game plan is required. One that includes a new business structure, in both literal and conceptual terms.

Companies with siloed operations will not be well positioned to reap the benefits of the highly digital and integrated environment of the next two decades. An evolution in business models is already underway, with early adopters moving to a collaborative, integrated and transparent ecosystem that incorporates multiple engines for growth and profitability while allowing flexibility to adapt quickly to changing conditions.

A new game plan is required to succeed in the Transformation Age.

An effective ecosystem includes transparency across the core business as well as visibility of key partners throughout the entire value chain, including sourcing, manufacturing, warehousing, distribution, customer delivery and final disposition of product assets.

Flexibility and adaptability will be critical components of successful businesses, allowing leaders, their boards and their business units to respond quickly and effectively to changes in market conditions. Companies with the ability to shape shift will be best positioned to take advantage of new and sometimes fleeting opportunities and to protect themselves from negative impacts.

Given that rapid change will be the characteristic feature of this time frame, creating an operating model that incorporates multiple options for market engagement is key. The capability to adapt and move among those options quickly is the competitive differentiation of winners in the coming decade.

Shaping a company’s future requires vision, planning, an appetite for change, and above all, communication with the board of directors, the executive team, the broader workforce, suppliers, customers and other key stakeholders.

“Your business approach and philosophy over-ride trends,” says Jim Tompkins, CEO of the supply chain consulting firm Tompkins International. “In this era of volatile change, optionality is optimal. We urge our clients to use business strategies that incorporate rapid learning, flexibility and above all, options. You can’t be brittle and succeed in this environment.”

A business model that accommodates multiple earnings engines works well in this environment, allowing capital allocation and resources to be shifted according to market conditions. Clear distinctions among B2B, B2C and B2e business units, as well as between product lines within those units, will provide valuable insights into lanes of opportunity, risk parameters and competitive factors.

Customer experience must be aligned and unified across internal business units, but the business propositions, functions and measurements of each business should yield a clear picture of separate and distinct earnings streams, risk parameters, market activities and competitive positioning.

The emerging business model is one that serves multiple stakeholder groups not just corporate shareholders. Interest and appeal is growing for investments in projects and initiatives versus whole companies. Following venture capital scenarios, these investors will fuel new and innovative products and processes.

Jim Tompkins, Ph.D., CEO, Tompkins International

Winning Business Strategies

Success in the Transformation Age will come to those companies that are willing to think differently about opportunity and risk, and to engage the marketplace in new ways.

Focus on problem-solving and providing value for customers. A customer-centric, outward-facing culture begins with the way business goals are expressed and incentives are awarded.

Find and deliver customer value in all aspects of product delivery, from components, features, packaging, delivery modes and sales channels to service and after-use disposition. View products and services from customer perspectives of problem solving, preferences and benefits.

Incorporate sustainability into corporate culture and all processes.

Broaden risk management perspectives and leverage enhanced decision-making tools that allow improved and timely insights into upside and outside risks.

Shift innovation to a core competency and process. Capture, encourage and share enterprise-wide ideas, activities and results.

Get in the game. Act on commercially viable solutions today within a flexible environment that can be modified quickly as future enhancements and capabilities become available. Don’t delay participation in smart automation and digital tools. The coming decade will be characterized by waves of innovation and enhancements.

Pilot and succeed or fail quickly. Learn. Adapt. Repeat.

Plan for alternative market scenarios using data decisioning tools to assess different strategies.

Be resilient. Adapt quickly to changing conditions.

Collaborate. Companies and their leaders do not have to win this race alone. Leverage outside partners and peers to collaborate, learn and implement new solutions faster and further than your organization can achieve alone.

Scale, broaden scope and invest in differentiating capabilities. Market boundaries will broaden in this decade, bringing disruptive competition to every geographic market and industry sector.

Leverage the new environment. Advances in the internet and digital tools, as well as evolving practices such as shared physical assets and freight delivery, allow even small and medium-size companies to leverage capabilities and information in ways previously only in the purview of larger organizations.

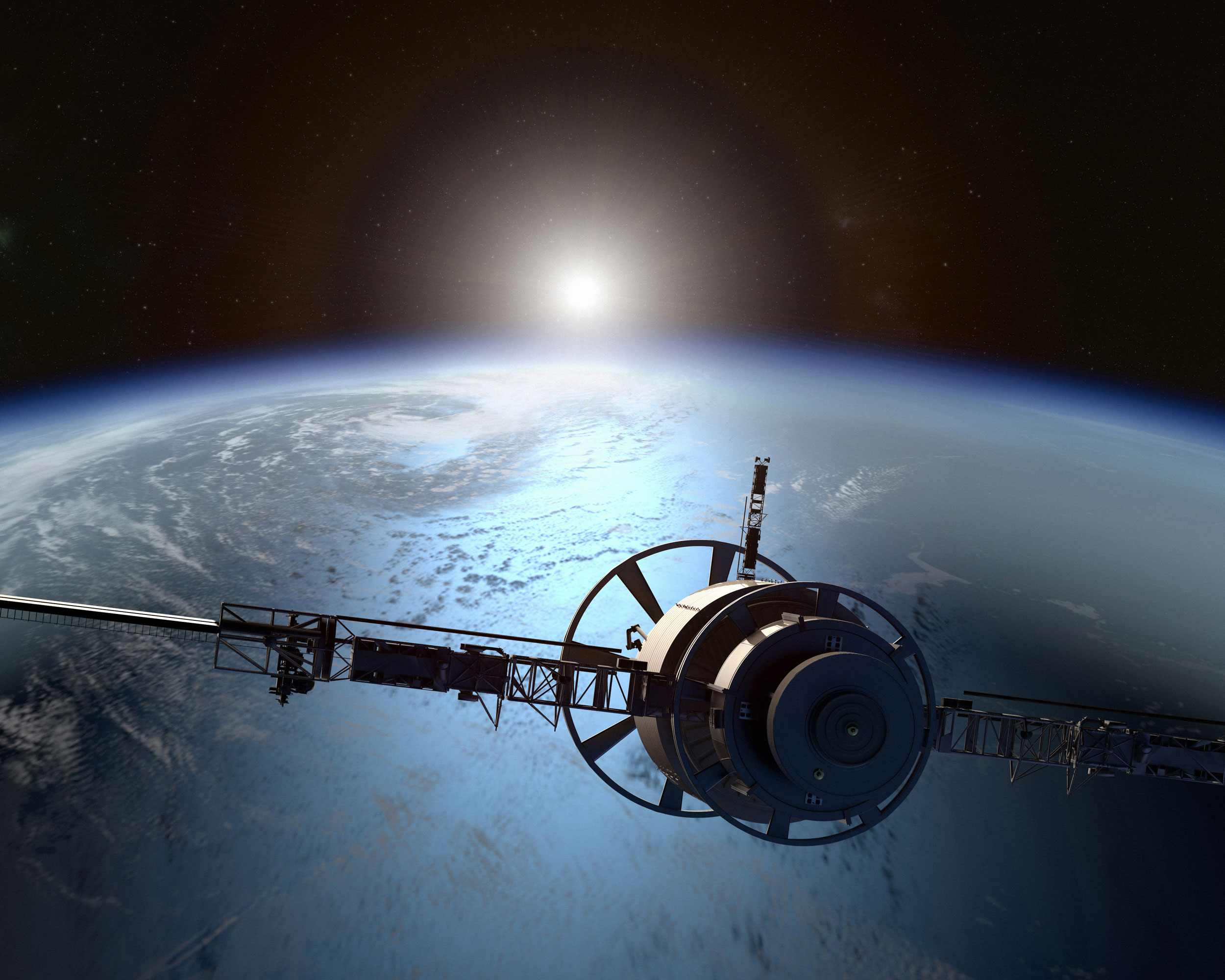

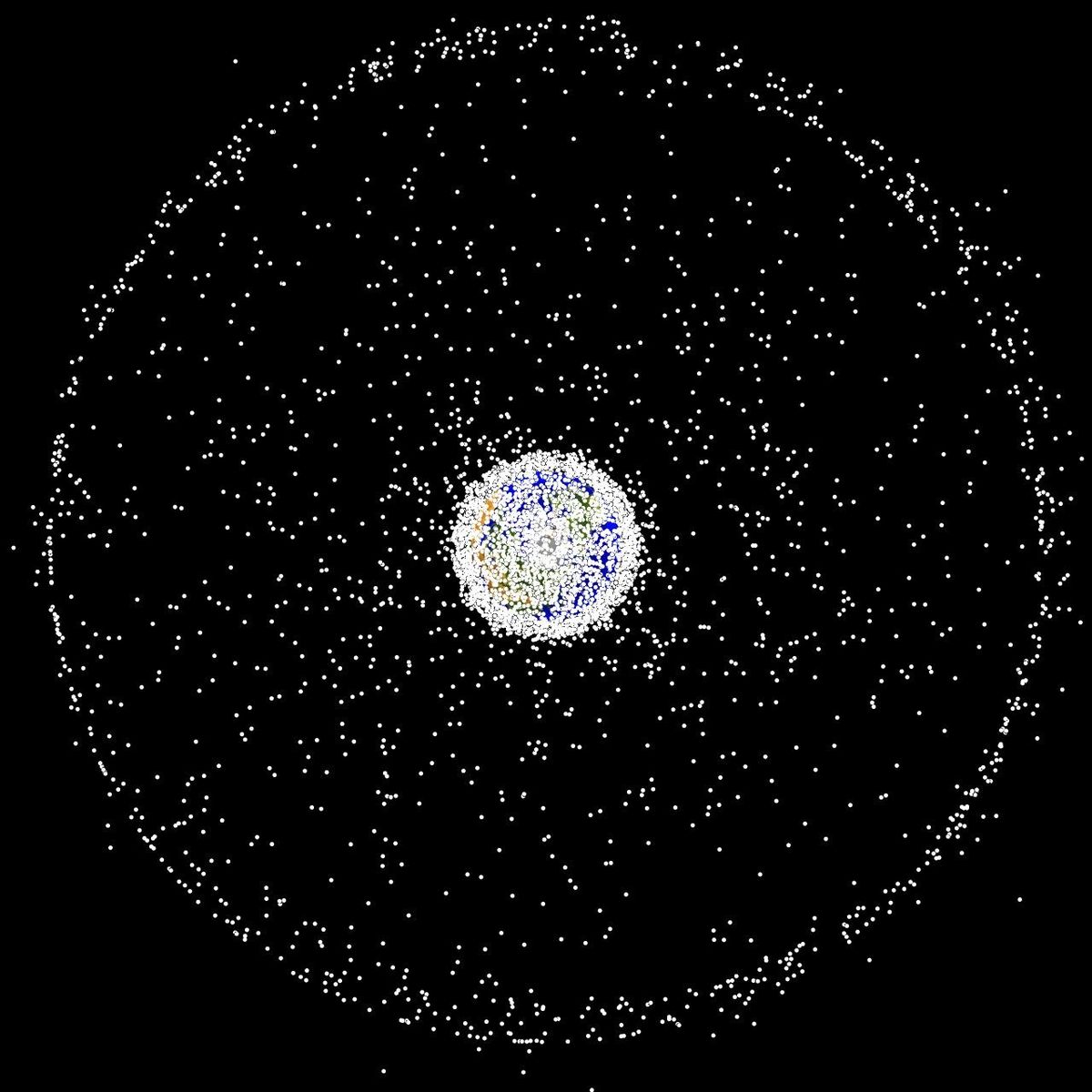

Forty years ago, financial services organizations collaborated to build regional and national electronic exchange networks to support ATM transactions across the United States and eventually the world. Similar opportunities in material handling and logistics will underly sharing of assets from satellite constellations to EV charging infrastructure.

Mergers and Acquisitions

The pace of industry consolidation will increase over the next decade. Firms will utilize mergers and acquisitions to increase scale, broaden scope and strengthen infrastructure positions in the market. These approaches can be utilized successfully by large, medium and small-size enterprises.

Lessons learned in other industries such as telecommunications and financial services that have been reshaped significantly by consolidation offer insights into key success factors: 2

There is no such thing as a merger of equals. Apparent equality changes after the transaction. There is always a single clear winner.

Over-communicate. Keep board members, employees and customers informed of changes and timelines.

Focus on integration not just conversion of systems and processes.

Shape post merger integration for long-term future state rather than post transaction status.

Distinguish between goals of increasing market share and productivity versus leveraging infrastructure and processes.

Ensure acquisitions are aligned with longer-term corporate goals.

Invest time and resources in a deep due diligence process prior to execution of the deal to ensure a smooth transition. Surprises come at a cost.

Fill leadership team positions with those who have the skills needed for the resulting company size and future growth goals.

Be deliberate in selecting the resulting company culture. Choose one and select a leadership team that will champion that culture.

Implement tight controls and processes, including board oversight.

Engage all financial business tools including tax and legal entity status early in the planning process to benefit from savings and other financial opportunities.

Expect a different regulatory environment as the company size increases. Increased scrutiny and controls and a different style of interaction with regulators should be expected as size increases.

Don’t overpay. Save money to use funds for other opportunities post merger or to pursue other acquisitions.

Specialty Plays

Growth and expansion of technology and engineering capabilities will spur some firms to diversify and invest in infrastructure, digital expertise or an emerging technology as a separate business. Other firms will divest operating businesses and focus on these singular capabilities as their new core.

Entrepreneurial activity will increase over the coming decade. Innovation and discovery will occur in stand-alone ventures as well as in company funded specialty business units established to leverage opportunity while protecting the established entity from risk.

Increased activity in all of these approaches will contribute to the re-engineering and transformation of the material handling and logistics industry over the next twenty years.

Timing

As smart automation and digital tools improve and adoption increases, pressure will mount on production, and timelines for delivery of equipment will lengthen.

The process of planning and scheduling the purchase, installation, training and implementation of new technologies is best done collaboratively, involving both outside suppliers and internal managers, to achieve desired outcomes for a successful and timely transition.

Opportunity

A convergence of technological and engineering advances, environmental issues, global and domestic policies, demographic changes and evolving consumer trends promises a challenging but exciting time in the material handling and logistics industry between 2020 and 2040 and beyond.

Long-awaited opportunities for dramatic increases in productivity, lower capital requirements for new equipment acquisitions, enhancements in portability of equipment, greater flexibility in manufacturing and distribution facility design, and evolutionary strides in transportation and freight delivery make the Transformation Age a time of memorable excitement and change.

Industry leaders must now heed strategic imperatives that have been under discussion for some time. Action in the near term is required for success and survival over the coming decade.

The path to 2030 is clear and the road beyond to 2040 is coming into focus.

Transformation requires change. But with a new course comes opportunity.

Industry leaders must now heed strategic imperatives that have been under discussion for some time.

Action in the near term is required for success and survival over the coming decade.

Sources

1 Tompkins International, “Tompkins International Business Strategies for Success,” 2020, tompkinsinc.com

2 Burchette & Associates, Inc. 2020, ”M&A Success Factors”

George Prest

CEO

MHI

Leadership vision and planning are critical elements in shaping a company’s future. Market information and insights play a key role in strategy development.

The Transformation Age: Shaping Your Future report paints a picture of market and industry trends that will present opportunities and challenges to companies in the material handling, logistics and supply chain industry over the next two decades.

We want this report to engage industry leaders in thought and discussion on key strategic topics. We will build on the themes identified in this report in other communications throughout the year, including podcasts and features in the MHI Solutions magazine, culminating in the annual conference in October where we will further explore these topics with keynote speakers and topical break-out sessions.

Emmy Lou J. Burchette

President & CEO

Burchette & Associates

The Transformation Age: Shaping Your Future report represents an evolution in the approach to the MHI Roadmap Series. For this edition, we combined insights from in-depth personal interviews with industry leaders and trend experts with findings from secondary market research to provide perspectives on ways material handling and logistics companies should prepare and take action to be successful in the coming decade.

This website serves as a digital report and provides an opportunity for readers to delve into a variety of subjects, from technologies to business strategies, and to consider how trends will impact our businesses, our industry and our world.

We invite readers to explore each of the six sections. Some topics are repeated and presented in varied contexts.

Let us know your questions as we work together to prepare for the future.

Transformation Age

Firm of the Future

A New Look

Looking out ten years, the vision for the firm of the future is clear. There is no doubt: the environment will be much different than what we experience today.

Leaders and their teams will be younger and steeped in technology. The workforce will be diverse, dispersed and highly skilled.

Warehouses and factory floors at leading companies will be highly automated and flexible to accommodate shifting priorities and demands.

The technology focus will embody human needs, making the shift to man + machine rather than emphasis on one to the exclusion of the other.

Education and training will be a career-long activity with both education institutions and companies utilizing advanced technology to speed and enhance the effectiveness of the learning process.

Collaboration and partnerships will bring together competitors and peers to leverage industry opportunities in new and exciting ways.

Industry consolidation will create new powerhouses, while entrepreneurial activity will abound in specialty areas.

Beyond 2030, change will not slow.

Continued commercialization of new technologies and enhancements of tools will emerge in waves of development throughout the following decade out to 2040.

Workforce

Leadership Transition

Today, top executives of most material handling and logistics companies are over 55. Many are over 60 and a fair number are approaching 70. The mix at the executive team table reflects experience, success and a good bit of gray hair.

The next decade promises to see a significant number of leadership positions transition to younger executives. The demographic shifts from older Baby Boomers to younger Baby Boomers, mixed with emerging Gen X and Millennial executives will bring new skills, perspectives and approaches to the industry.

Source: U.S. Census Bureau data. Graphic by Burchette & Associates.

These demographic shifts bring more than just age changes to the top ranks. Decision-making styles, risk tolerances, technology knowledge, global perspectives and comfort levels with change differ in this group from their predecessors. Members of the emerging group are comfortable with a higher degree of uncertainty, an environment most have experienced throughout their lives.

While some senior leaders will continue to lead through the next decade, others will elect retirement. Across the board, a lot of change at the top will happen throughout the industry. With that change comes loss of legacy knowledge, experience and valuable peer networks.

A concern commonly voiced among a number of younger executives is the potential loss of legacy information and expertise held by those retiring – information that is not widely known or well documented in some companies. Younger executives recognize the Importance of this key and sometimes proprietary knowledge and are seeking ways to capture these intangible assets as older executives retire. Companies would fare well by focusing greater attention on this information transfer.

These emerging leaders enjoy learning from their company’s executives and look forward to contributing to the future success of the organization. Their perspectives reflect a strategic view that will continue the strengths of their predecessors’s approaches and build on those with new technologies and processes. The combined result will arm their companies with knowledge and expertise vital in the Transformation Age.

Download Section PDF “Firm of the Future”

Kevin O’Neill, President, Steele Solutions

“We need to pair younger executives with senior leaders to retain valuable knowledge and expertise as transitions occur.”

Living with Change

In recent in-depth interviews with seasoned supply chain industry leaders, top executives describe the industry as undergoing significant and rapid change. They are focused on making needed investments in facilities, equipment, processes, technology and workforce skills. Their view of the next 10-20 years is unanimous: the pace of change will accelerate as innovation and technology drive new approaches and capabilities.

Many have strategically positioned younger executives throughout their company to bring new ideas and skills to key operations. Technology knowledge is often cited by top executives as the area they look to younger executives to understand, navigate and lead.

Today’s leaders acknowledge the pace of change will increase throughout the next two decades, but they remain uncertain about the timing and scope of impact various trends may exert. Many view this uncertainty as unsettling while others are invigorated by the excitement of new frontiers.

Younger executives view change as a ubiquitous marketplace and competitive factor, and see technology as a valuable enabler of new levels of efficiency, speed-to-market and profitability. Technology is also viewed as the means for meeting increasing customer demands for customization.

Those under 50 are familiar with a wide range of digital, automation and engineering technologies. But just as their senior executives do, they rely on technology and engineering specialists in their company, integrators, and service and product partners to select and execute new platforms, equipment and processes. As a group, they tend to have a higher level of comfort than their predecessors in guiding their company directionally without having mastery knowledge of the technical tools required for successful execution.

In viewing the future, both groups believe advances in technological, engineering and data decisioning tools will drive continued improvements in safety, efficiency, time to market, and business partnerships and collaboration. They also share beliefs that consumer demand for customization and immediacy of delivery will continue to shape material handling and logistics in the future.

Industry Networking

As a time-honored tradition, industry leaders actively pursue networking opportunities to examine and share ideas related to industry trends and changes. For many, their long-held friendships with company and industry colleagues represent important ties enabling productive collaborations and partnerships.

Younger executives are seeking meaningful industry networking opportunities. They view these opportunities as one of the most vital ways they can learn from other industry executives as well as global trend experts. They highly value inclusion in industry and association meetings and events, describing these opportunities as key to their continued professional growth and development.

Generation Z Workers

By 2030, the younger Gen Z employee group will bring another wave of new work styles, skills, preferences and expectations to the workforce. Their leadership styles will be impacted by the Gen X and Millennial group they encounter in their first decade of working, but they will equally impact corporate cultures and leadership models by the sheer size of their generation and their strong convictions and belief systems.

While a lot of attention is focused on meeting the needs of Millennial workers in 2020, companies need to prepare now for this next influx into the workforce. Representing a group larger in size than Millennials, numbering roughly 65 million in the U.S. and 2.47 billion worldwide, this generation will impact the industry from both within as employees and without as customers. 1

By 2030, older members of this group will be emerging as young professionals. This group is already known for high expectations for workplace diversity, inclusiveness and technological savvy. 2

Due to their lifelong exposure and use of technology, this group actively uses a variety of technological tools in their personal and work lives. 3 They look to technology rather than people as the first stop for information, whether that is to learn something new such as a game or a process, or to communicate among peers and co-workers.

The timing of Gen Z emergence in the workplace aligns well with the increasing prevalence of smart technologies, data decisioning tools, and geographically dispersed workplace locations.

Gen Alpha

The youngest generation emerged in 2010. The children of Millennials and GenZ will be entering the workforce by 2030, bringing with them a new reality of the world. Theirs is truly a viewpoint shaped by a technology lens and a global perspective.

Growing up with digital platforms, this group is already influencing families and institutions. 4 In the workplace, this generation promises to be the one that is skilled and prepared for innovation of thought and execution of new ideas. The grandchildren of Baby Boomers and Gen X , Gen Alpha employees will realize the dreams of industry leaders who are pioneering change in the dawning years of The Transformation Age.

The grandchildren of Baby Boomers and Gen X, Gen Alpha employees will realize the dreams of industry leaders who are pioneering change in the dawning years of The Transformation Age.

Gen Alpha are growing up with technology and digital platforms shaping their life experiences. Artificial Intelligence will power many of their choices and decisions, from clothing to careers. Augmented reality and virtual reality games and tools will prepare them for a workplace that manifests an environment of change measured in seconds not days or years.

Raised in environments customized and personalized for family and individual preferences, employers will have to deliver workplaces that mirror the context of individual uses.

It is not too early for the industry to address how this generation is educated and trained. Courses, content and delivery channels beginning with toddler toys can impact adult workforce readiness skills.

Diversity

The Gen X and Millennial groups will bring greater diversity to leadership and broader workforce participation in the industry in the coming decade. Today’s industry leaders welcome greater participation by these groups evidenced by their support of industry and company initiatives to recruit and hire qualified candidates across the board. Global diversity initiatives in STEM education over the last decade are reaping an increasing number of diverse candidates for the industry.

In recent interviews, industry executives voice beliefs that having more women and members of various ethnic groups in leadership positions will help evolve industry practices related to Human Resources and contribute to greater understanding and improved relationships across supply chain participants.

Industry executives’ recognition of the need and their willingness to pursue greater diversity in the workforce are already helping the material handling, logistics and supply chain industry attract more women and more people from varied ethnic groups. Many industry firms participate in local education collaboratives to attract high school students in all demographic groups to careers in the field. A number are now advocating for more involvement with schools and students in primary grades to ensure skills are developed and interests nurtured well before secondary education courses and degrees are selected.

In the 2030-2040 timeframe, greater diversity in the industry will be shaped strongly by the Generation Z group that demands inclusiveness in real terms, not just numbers. 5 Their collaborative nature will impact the development of work groups and shared accountability systems that will increasingly drive integrated processes throughout the Transformation Age. One can expect the same impact from Gen Alpha. Age, gender, sexual identity, religious preferences, and even national citizenship will become less important than workplace credentials, with expertise and skills becoming the true differentiators. The proverbial “A Team” will become a respected, highly diverse group of individuals who work collaboratively across corporate ecosystems of employees, suppliers, and customers.

New technologies such as smart automation, robotics and augmented reality will enable older men, women and physically challenged individuals of all ages to participate in job classes previously less attractive to them due to physical labor requirements. As these technologies replace physical labor, and job requirements shift to intellectual capital, more individuals will qualify and be attracted to a larger field of jobs. This growing diversity will be present throughout the supply chain and have attendant impacts on related company cultures, policies and procedures.

Organizational Culture

Shifts in the organizational culture within supply chain industry companies began in earnest in the last five years. Success in the coming decade warrants a more significant evolution, one that literally transforms the Human Resources department’s functional scope to encompass all facets of Employee Experience (EX), and builds a climate supportive of innovation and discovery, collaboration and integration of functions, and career-long learning.

This dynamic requires attention now as expertise in these areas becomes as important as investments in smart automation and digital technologies.

Companies will need to increase funding for human resource initiatives over the next five to ten years in order to prepare, create and sustain the environment required for success in the Transformation Age. These investments are in addition to those needed for technical training. Additionally, existing management and leadership curricula will need to be retooled or developed anew to support the evolving environment.

While younger workers may come aboard with more finely honed technical expertise, communication skills for successful collaboration across the enterprise will be an area of increased need.

Industry firms need to become learning institutions and employees need to become active learners. A culture of career-long learning will differentiate leading companies and characterize industry champions.

Labor Force Shortages

Coming into 2020, the single greatest labor force challenge reported across the industry is finding and retaining qualified skilled workers. The outlook for the next decade and beyond brings no relief to that situation absent significant changes in the utilization of smart automation equipment and processes. Hence the evolving scenario, where the situation is not solved but rather changed by new approaches.

Both seasonal and permanent labor shortages abound. This situation already demands changes in recruiting, salaries, training and retention practices. Enhanced strategies in these areas will serve companies well in the future, as shortages and churn in the labor force are expected to continue. Projected demographic, education and training trends do not support an adequate solution to this labor shortage in the coming decade. Automation of jobs is viewed as the single greatest opportunity for relief.

The race to solve this issue is moving quickly. Companies that are able to marshal the financial resources to address their labor shortage through smart automation as soon as possible will reap significant financial benefits over the next 20 years while enhancing their speed to market and competitive positioning. Those who cannot make such investments in the next five years may lag behind at best or cease to operate or be acquired by larger organizations by the end of the decade.

Automation of Jobs

Industry leaders expect continued growth in automation of jobs, resulting in significant loss of people in some job categories. With this view comes the positive expectation for an increase in safety, efficiency, time to market, customization capabilities and competitive positioning.